You’ve heard of bitcoin but you have no idea if or how to get some in Japan. Is it a speculative bubble, or is there more to it than that?

You want to understand cryptocurrency, but it is really confusing and you have no idea how to get started. Here’s some background information and how you can get started buying Bitcoin in Japan.

If you already know about the technology and just want to know how to buy Bitcoin and Altcoins in Japan, click HERE.

Disclaimer: This article is based on my limited understanding of bitcoin and altcoins, but I hope it will be useful for you. It could go up, it could go down, and it’s up to you to decide if you want anything or nothing to do with it. This is not financial advice, obviously!

What is Bitcoin?

Bitcoin is a cryptocurrency built on a technology called blockchain (more on this below). It is a store of value (a currency) that is created entirely digitally but not owned by a company, so there is no CEO or corporation behind it, although there are founders and key figures like Nick Szabo (creator of the first digital currency Bitgold), Satoshi Nakamoto (probably an alias for one of the key genius minds behind blockchain and Bitcoin), Gavin Andresen and Hal Finney (key architects of the blockchain technology and Bitcoin), Barry Silbert (early investor), and the Winklevoss Twins (heavy early investors).

It is open source and publicly distributed so that everyone can use it as a store of value independent of nationality or country. They are digital coins that you can send through the internet, peer-to-peer, in any country in the world, without being checked by an external authority that controls the supply, value or charges fees for transaction or exchange. There are no limits to how much you can spend or use, and your account cannot be frozen by a government or bank. There are no bitcoin banks in the traditional sense, rather, when you get a Bitcoin wallet… congratulations! You ARE a bank.

This might mean nothing less than total financial freedom, and everything that comes along with it, including the potential to lift millions or billions of people out of poverty who would otherwise be unable to store wealth at all, and also the ability for criminals, mobsters or terror organisations to use this currency to fund their illegal operations without governments or law enforcement to trace or block their transactions. If you do a little more research into the underlying technology it’s easy to get totally carried away with how much this will either destroy or revolutionise our world trade systems, but like all technologies when they first start out, there are a lot of technical and legal obstacles, problems and kinks to work out.

You can learn more about Bitcoin at these links:

https://www.coindesk.com/information/what-is-bitcoin/

https://www.bitcoin.com/getting-started

http://money.cnn.com/infographic/technology/what-is-bitcoin/

https://en.wikipedia.org/wiki/Bitcoin

https://blockgeeks.com/ – Learn the basics all the way up to be becoming a blockchain engineer

What is the difference between Bitcoin and Blockchain?

Blockchain is (really simplifying here) a ledger of transactions that is public and verified peer-to-peer, making it next to impossible to falsify transactions or change them once they have been written to the ledger, which we all have access to and can see at any time; it would require a significant percentage of the total available computing power in the world to successfully hack (theoretically). This technology is being heralded as having the potential to revolutionise trust. In fact, you can verify every single transaction on the Bitcoin blockchain with open source technology on websites like Block Explorer.

Satoshi Nakamoto (whoever he, she or they are) explained:

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

Read more about Bitcoin from the original white paper Satoshi released in 2009.

It seems like every ten years we have a huge financial crash where average people lose their homes and jobs, and the rich somehow get richer, or get bailed out because they are “too big to fail”. It’s no surprise that Bitcoin was released shortly after the Lehman Shock of 2008. People have lost trust in the banks and authorities that control the money supply, and nobody can blame them. Blockchain could completely turn that on its head and make it much harder for malevolent financial bodies to manipulate currency value. Bitcoin is hard capped at 21,000,000 coins, so when it reaches that point there will be no more supply… EVER. This could mean a stable currency that doesn’t deflate in value over time as current fiat currencies do.

If you want to understand about the history of this technology and what it is about, check out Banking on Bitcoin, a Netflix documentary all about it. There’s so much to learn, I’ve barely scratched the surface myself.

Check this video out to understand more about how blockchain will revolutionise many industries, and give you some idea as to why wealthy bankers are scared of this technology:

Then what are Litecoin and Ethereum?

Without going into exhaustive detail, these are other cryptocurrencies based on a slightly different blockchain technology, and are sometimes referred to as altcoins.

Litecoin, the first altcoin, was created by Charlie Lee after a fork from the original Bitcoin blockchain, and is a similar store of value to Bitcoin, but it is far more efficient and sales can complete fast enough for it to be used in live transactions. Where an average Bitcoin transaction takes a few hours to verify, a Litecoin transaction can be as fast as a few minutes. There is also far more in circulation which could make it much easier to use for small ticket items.

Do you really want to buy a cup of tea for 0.0000711894 bitcoin?

This tech still has a long way to go but efficiency could make it faster than Visa, but it is still up in the air whether this technology will win out in the long term.

Ethereum is a different blockchain technology being worked on by Vitalik Buterin, and is designed for smart contracts and decentralised apps. What this means is that Ethereum can be used to build applications that are fully trustworthy, because they run on the blockchain and become transparent and can be checked through the public ledger. While there is a currency aspect to Ethereum (called Ether), the real power of this technology is what can be built on top of it using the blockchain to create trust.

Watch the video above to get some idea of how that might work in real situations, and why banks like Barclays are using it to save time and money on international trade and contracts.

Why some people are saying to avoid it

When you look at what is driving the incredible and insane value growth of Bitcoin and other cryptocurrencies, it looks an awful lot like a speculation bubble. This is very similar to what happened with the dotcom boom during the 1990s up to the turn of the century. At the time, massive speculation about internet based companies fuelled investment spending that came to a head in 2001, where trillions of dollars in investment basically evaporated as many of the companies expected to make incredible technology folded simultaneously.

As nobody really yet understands the potential applications (or failings) of this technology, a lot of people are starting to wonder if this is a similar boom and bust situation. Will bitcoin prices continue to rise as John McAfee (owner of possibly the biggest crypto mining operation in the world) predicts will happen by the end of 2020? Who knows. I’ll let you decide, but my advice would be to do lots of research and only put in money that you can afford to lose.

Another possibility is that with Bitcoin futures starting (the stock market investment option), many traders and financial institutions will use this as an opportunity to undermine already shaky public trust in the technology, and short Bitcoin to force the value to drop.

How do I get cryptocurrency?

All you really need is a bitcoin or altcoin wallet and you can start accepting cryptocurrencies and storing them. At the moment, this basically means you’ll need to go to a cryptocurrency exchange if you don’t know anyone who will trade you them for real money. There are a lot of exchanges around the world, the most popular ones being:

Coinbase (Google Play, iOS App Store) – recommended for beginners…

…but not available in Japan yet; you need a phone number, address and bank in a country that they support.

LocalBitcoins, CoinMama

Both available in Japan, but I haven’t used either and can’t comment on their process.

Other well known exchanges include CEX.IO, BitFinex, Kraken

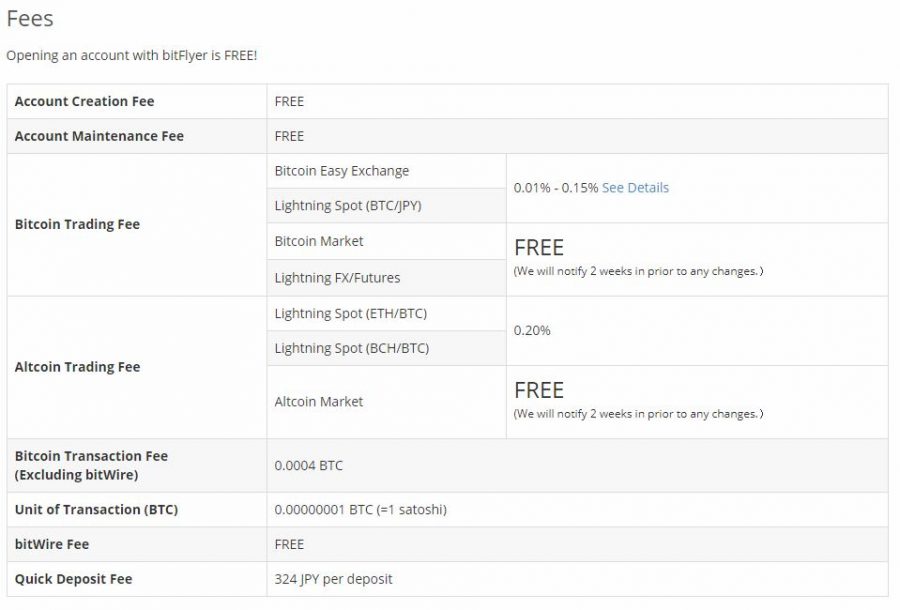

The most well known exchange in Japan – bitFlyer (English link)

Don’t get scammed like I did! Don’t use a credit card to buy bitcoin EVER.

BitFlyer is very sneaky about their fees, and take an extortionate fee on transactions made with credit cards. I think it is borderline illegal what they do with credit card transactions and I’m planning to query it with the Japanese FTA and see if what they did was in fact false advertising. When I put my trade through it only listed the amount of bitcoin that it was worth, and didn’t reference the fact that it was going to take a HUGE chunk of that as a hidden fee. From my investment they raised the market rate by 15% for the credit card exchange. On their website, the fees are listed like this:

Bitcoin exchange says 0.15%, not 15% (100x more). After querying with them they told me that they don’t publish their credit card fees, with no explanation of why.

The proper way to do it

Learn from my mistakes and do it the right way.

Step 1 – Register your address:

To prevent fraud and money laundering the Japanese government has regulated Bitcoin and crypto exchanges, and requires that you receive a non-forwardable postcard to verify your current address. You cannot trade bitcoin until you do this, so set it up as soon as you make your bitFlyer account so you can start trading faster.

Step 2 – Register your Japanese bank account

You have to put in all the details of your bank account and then, once that account is verified and the postcard from Step 1 is delivered to your address, you can wire bitFlyer your money. There is a fee of ¥324 to wire money to them, but I guess it’s 仕方がない (nothing you can do about it). It’s much better than getting screwed on credit card fees.

Step 3 – Buy/Sell Bitcoin

Use the left panel to select buy/sell Bitcoin and choose how much money you’re going to put down. I mentioned this before but I say again: only invest money that you would be okay with totally losing. Bitcoin is incredibly volatile and with Bitcoin Futures trading opening on the Stock Exchange the value could skyrocket or plummet.

Good luck and happy trading! I hope Bitcoin will continue to grow as there is a lot of potential for this to help us prevent big financial crashes, and increase our trust in both public and private institutions. We won’t know until it happens, so keep reading and learning about it (YouTube is a great place to learn about it if you listen to the right people) and stay sharp.

“hodl” – the Battlecry of the Crypto Community

When people buy cryptocurrency, it can be very stressful to say the least. Just take a look at an Ethereum trade in June that dropped the price in seconds from over $300 per Ether to less than $0.10!

Which user did it? Nobody makes a multi-million $ market sell order, unless they have an intention to manipulate the market.

— Boban Milošević (@bobanmil) June 22, 2017

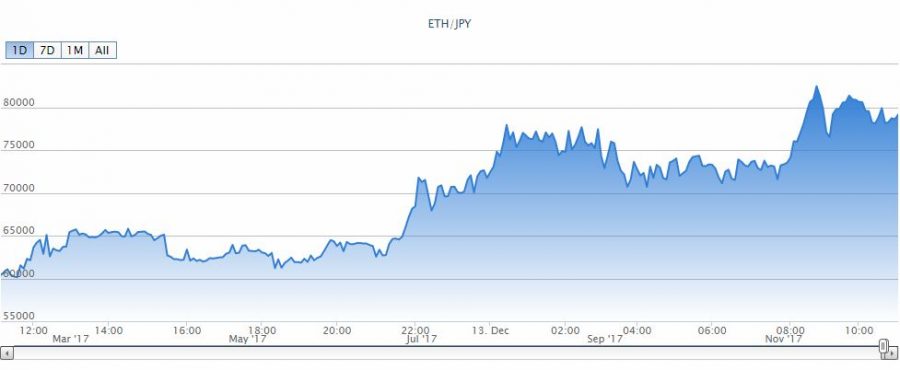

This is why crypto community members have given to using the acronym “hodl” – Hold On for Dear Life. The crypto markets go up and down, and unlike in stocks and shares trading where a 30% value gain per year could be considered huge, in the crypto world that could happen in a matter of hours. This is a graph of Ethereum growth on the day of publishing this article (Dec 13th):

So when you buy crypto, you have to stay calm. The value can go up or down based on big trades, whims of genius programmers, hackers and entrepreneurs, or even tweets from Mark Cuban.

You NEED Security

If you know anything about computers, its that they can be hacked. Phones can be hacked, companies can be hacked, and exchanged can be hacked. The famous hacking of Mt.Gox exchange in 2014 of around 850,000 Bitcoin, as much as $400 million at the time, could be valued in today’s money at over $100bn. Just a little while ago at the time of writing a Slovenian exchange NiceHash was hacked, with 4700 coins, or $64-90m stolen.

How do you keep your money safe?

You’ve got Malware. Have you heard of keyloggers or screen capture technology? They are put on your computer by malevolent forces to steal your passwords and login details and use that data against you. These kinds of malware are everywhere and they are quite hard to deal with. You get your keys from the screen on your phone or your computer, or type them in, guess what – a hacker could instantly have your keys. So how do you stay safe? There’s a great talk here from John McAfee about crypto security that you should check out.

Don’t keep it in an exchange. All of them are vulnerable. CoinBase, bitFlyer… none of them would be able to predict an attack and you might not find out until you check your money and find it gone. You need to secure it yourself. There are a few ways to do this.

Hardware Wallets

While not completely un-hackable and safe by any stretch of the imagination, hardware wallets are by far the safest way to store your cryptocurrency. They use partitions to make sure that access to your private key is separate and cannot be read by software accessing it on your computer, or in any other way than the screen on the device. There are a few available today, with the cheapest being the Ledger Nano S, making it a very popular option. It isn’t very user friendly, but there are great tutorials on YouTube on how to set them up and use them. Be sure to get your hardware wallet from a safe location or official supplier, not from eBay or anywhere second hand if you’re trying to save a few yen. Second hand wallets could have been modified to allow them to be hacked, so just pony up and buy a hardware wallet.

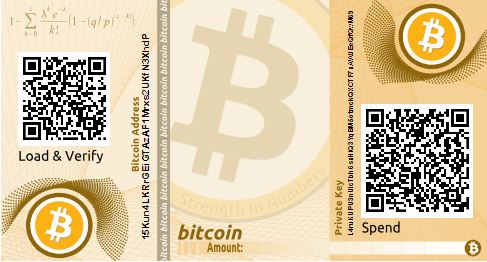

Paper Wallets

A paper wallet is basically just that – it’s a piece of paper that has a QR code with your public key so you can send and receive money to that address. It’s a lot harder to check what you have, and while you can keep your public and private keys separately, it can be risky as if anyone ever gets a hold of them they can target you or even take your month, and there would be nothing you could do about it. Keep them safe and away from prying eyes and this may be the most secure way of holding your bitcoin.

You can create and print one off at bitaddess.org (or liteaddress.org for Litecoin). It will generate a paper wallet for you that you can print out. Be sure to read a tutorial on this first, like this one from coindesk, before you make one. And don’t go scanning the QR codes randomly!!!

This is what one looks like – keep the private key separately!

I know you’re smart and you read what I posted above, so you’ll know that there is some risk to taking one of these from the internet. If you’re worried that you might have a keylogger on your computer and have no idea if it’s safe, you can find a Bitcoin ATM.

Bitcoin ATM – They have them around Tokyo, and you can find a local one here. The fees here are pretty high, maybe as much at 7% on top of market trade rates, but I’ve been told that you can print out a paper wallet here for free. Give it a try!

Important: don’t tell anyone how much you have

This is how you stay secure from real-life dangers. What use is it to have private keys and hardware wallets if you go around telling everyone that you have 10 bitcoin hidden away somewhere? Then anyone who finds this out can just beat you up or threaten you so that you reveal your private keys or transfer all of your money to them. This happened to a NYC man who met someone on craigslist to buy bitcoin. Yeah, stupid I know, but it can happen in less stupid ways too. While it might not be the worst thing to lose when it is not worth much, remember that from a lot of analysts perspectives this is going to blow up, especially now that it has garnered more interest and legitimacy through regulation in Japan. That man who got mugged? He lost $1,100 of bitcoin at the time. It was in May 2015, so he had approximately 3-4 bitcoin, worth upwards of $55,000 in today’s money.

Don’t be a fool, and don’t brag about how much money you got. I shouldn’t have to stay this but please just be smart.